What KPIs Really Matter for Growth

Here’s your Startup Tip of the Day

Happy Wednesday Founders!

In traditional corporate finance, you typically learn the 3 most important financial statements:

- Profit & Loss (P&L) (or Income Statement)

- Balance Sheet

- Statement of Cash Flow

A Profit and Loss (P&L or Income Statement) will indicate the overall income, cost of goods sold, gross profit, expenses, taxable income, interest, and net income. A balance sheet can be thought of as a snapshot on a particular day in time for a business — how much cash is on hand, what are the short and long term receivables, liabilities, debt, and overall equity position of the company, and of course, Assets equals Liabilities plus Shareholders Equity. Finally, a Statement of Cash Flow indicates the inflows and outflows of cash to an enterprise from sales, investment activities (interest income), accounts receivables and accounts payables, taxes, cash flow from from any financings (investment rounds, debt), and ultimately the net change in cash.

By evaluating all three financial statements, a Founder or Manager can have a pretty good idea of the financial health of a company. However, here’s where these three statements don’t show the full picture.

Over the last 10 years or so, tech and software related startups, especially in Silicon Valley, NY, Boston and some of the other hubs, have found themselves in interesting financial situations whereby they’ve raised VC rounds of financing, but don’t have the focus on growing profitability until a later point. All focus has been on growing top-line revenue as fast as possible to build market traction, increase brand awareness and domain authority, and position the venture with enough compelling (and irrefutable evidence) of growth, that unlocks subsequent future rounds of VC financings — Series A, Series B, Series C, Series D, IPO or even an acquisition as a liquidity event.

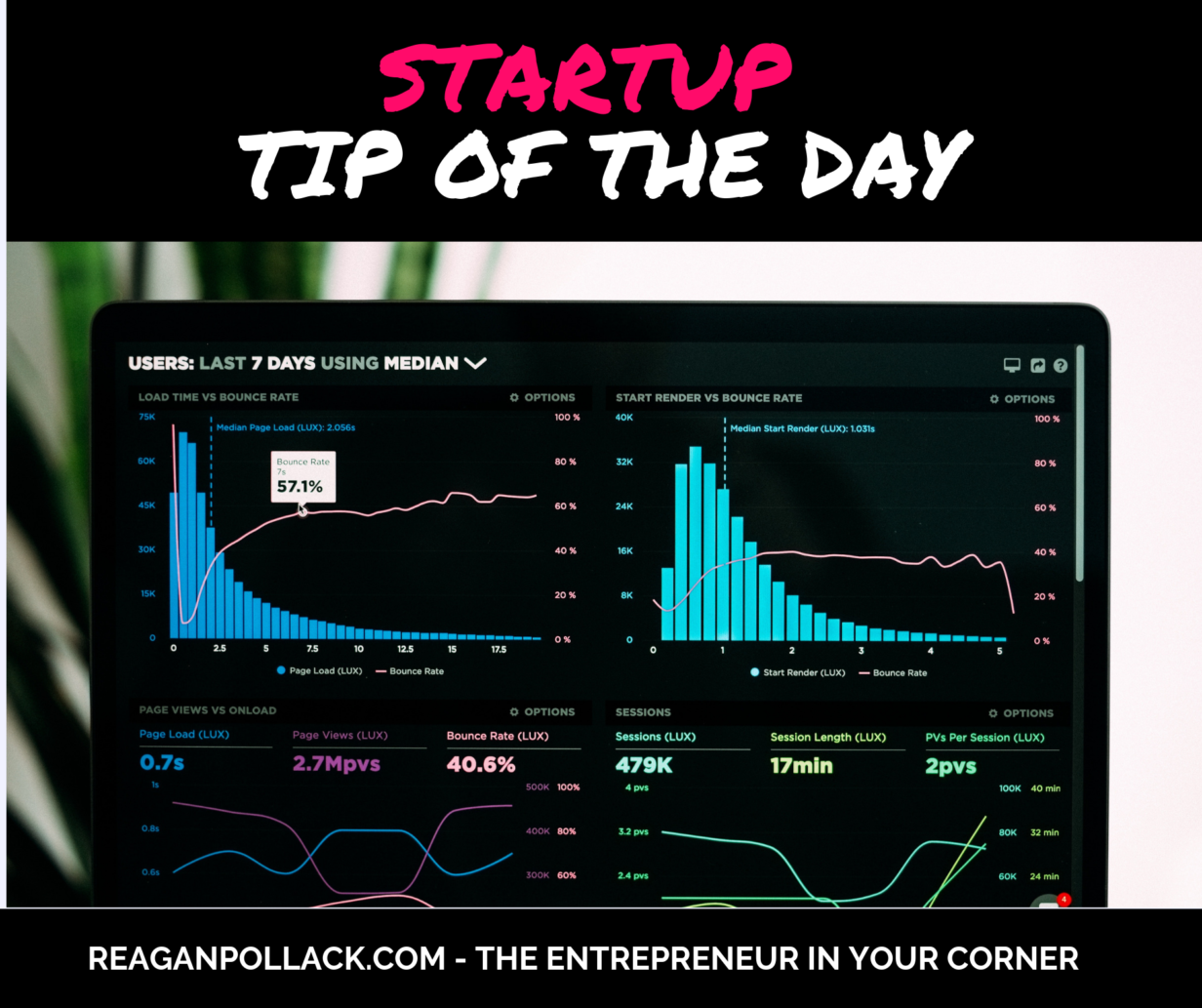

So to manage the day-to-day operations and keep a keen eye on the metrics that matter to keep all wheels spinning as fast as possible, a series of Key Performing Indicators, or KPIs, emerged as a way to identify, isolate, evaluate and implement specific actions that fuel performance and hyper growth.

Why does this matter for your startup?

Well, for starters, what you measure tends to grow. If you are only measuring historical performance of revenue and profitability say over the past fiscal year or quarter, then you get into a pattern of keeping your head to the grind stone, and only coming up for air when the period is over to tally everything up to see how you performed, or if you underperformed. It is very common for companies to have no idea where they are truly at on a day-to-day, or week-to-week basis when operating under the standard “quarterly” or “annual” audit program.

Conversely, if we adopt a new way to analyze our companies and evaluate our daily and weekly growth, we put our companies, employees and investors in the best position to realize marginal and sometimes seismic activity and adjust, pivot or accelerate accordingly based on the data.

Every business depends on Revenue Management, Expense Management, and Cash Flow Management. However, each business has a different set of KPIs that matter most to their goals, business model and industry.

For a simplified non-tech example, a Restaurant of course seeks to increase their revenue, decrease their food cost, and thereby increase the profitability overall. However, measurable KPIs that might trigger to an ultimate display of this pattern might include:

- # of Appetizers orders placed per service period (the more you sell, the more profitable each order becomes)

- # of Cocktail orders placed per service period (the more you sell, the more profitable each order becomes)

- # of Dessert orders placed per service period (the more you sell, the more profitable each order becomes)

- Length of Table Occupancy per service period (the faster you turn over a table, the more revenue you make)

- Busiest & Slowest Hour Windows per service period (understanding this helps you optimize how many staffers to have on hand, by reducing # of waiters you reduce overhead expenses, by offering specials during specific slow hours you increase revenue and offset expenses during slower hour windows, etc)

- # of Minutes Each Customer Waits for a Table (if you find that the average wait time is 15 mins, and 1 our of 4 customers defect, by reducing the waiting time, you remove the attrition rate and thus increase revenue, profitability and customer experiences)

- Customer Lifetime Value (the more frequent a customer returns to your restaurant, the more profitable each subsequent meal becomes as you did not have to re-market to them, and for example, on average a repeat customer typically brings at least 1 person with them on their next visit, thus doubling revenue and profits).

By measuring the little things on a daily basis, instead of just the overall top and bottom lines, we start to optimize our operations to produce better results that help us scale faster, hire more frequently, and increase the value for our customers.

Use KPIs to measure what truly matters for both your business, but more importantly, for your customer.

Recent Comments